Day trading tax calculator

The default values already entered are for an E-mini SP500 ES trader making 125 points per trade etc Ask. Income seems like a straightforward concept but little about taxation is straightforward.

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

For day trading you simply pay tax on your income after any expenses.

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. If a stock is held for less than. Open An Account Today.

ITR Form ITR-3 For individuals and HUFs having income from profits and gains of business or profession Due. Ad Were all about helping you get more from your money. A capital loss can be deducted from the rest of.

Learn more about TradeStations award-winning trading software brokerage services. Learn more about TradeStations award-winning trading software brokerage services. Calculate Advance Tax on Trading Income.

Business Income and Losses. Lets get started today. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

The tax on day trading profits should never be overlooked because no matter how big of a profit you book at the end of the day you have to pay the day trading capital gains tax. 900 am to 500 pm Monday to Friday on working days Contract trading cycle. The first category is speculative in nature and similar to gambling activities.

Date Calculator Add or. There are two capital gains rates in the US that can affect taxes on day trading. Enter the values that match what you trade to find your target millionaire date.

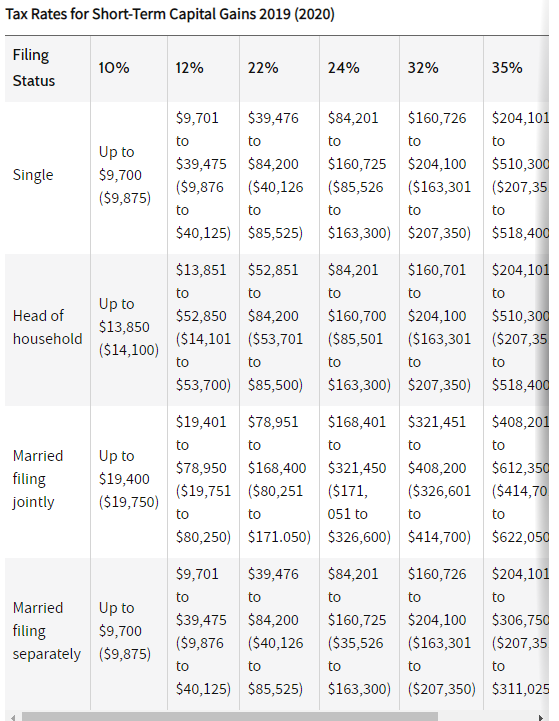

The gain realized from selling a long-term holding is taxed at a lower rate than short-term gains. Whats more those trades amount to at least 6 of your total trades during that. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Ad Real-time quotes and premium tools to help you with enhancing your trading experience. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad TradeStation Ranked One of Americas Top 5 Online Brokers Overall.

Similar to investing the tax also accounts for the losses. Ad TradeStation Ranked One of Americas Top 5 Online Brokers Overall. 12 month trading cycle.

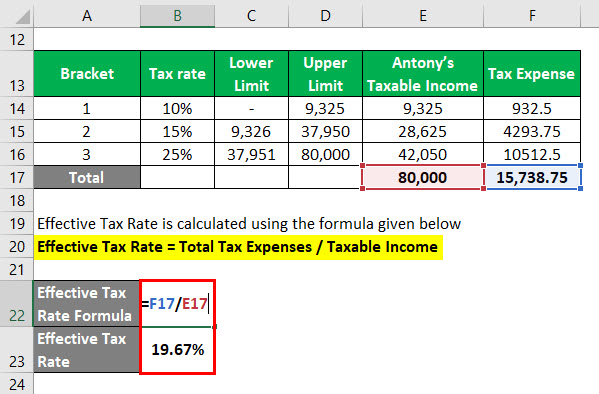

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Many new investors view day trading as an efficient way to earn money quickly. If the tax liability of the trader or investor is expected to exceed Rs.

10000 then they must calculate and pay Advance Tax. In the case of individuals HUFs engaged in intraday trading the applicable tax rate will be ranging from 5 to 30 plus surcharge cess depending upon the income slab. If you fall under this bracket any day trading profits are free from income tax business tax and capital gains tax.

To the IRS the money you make as a day trader falls into. As a result you cant use the 50 capital gains rate on any. The idea behind the concept is to make trades over short periods to take advantage of short-term.

Open An Account Today. This sale results in a long-term gain as the holding period was more than 365 days. A pattern day trader executes at least four day trades within a five-business-day window.

Time and Date Duration Calculate duration with both date and time included. The long-term capital gains rate and the short-term capital gains rate. Leverage Webulls customer support and knowledge building.

FO Intraday Trading Non-Speculative Business Income. 025 paise or INR 00025. Duration Between Two Dates Calculates number of days.

Communicate with other traders. Day Trading For Dummies. For day traders any profits and losses are treated as business income not capital.

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Cryptocurrency Tax Calculator Forbes Advisor

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Day Trading Taxes How Profits On Trading Are Taxed

Forex Trading Academy Best Educational Provider Axiory

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading

Irs Wash Sale Rule Guide For Active Traders

Effective Tax Rate Formula Calculator Excel Template

Crypto Tax Calculator

Create Your Day Trading Profit Calculator In Excel Stockmaniacs

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

How To Keep Track Of Your Day Trading Gains And Losses Dummies